Lifestyle Spending Accounts (LSA) have become a popular component of modern employee benefits packages. They often focus on wellness-related expenses outside of traditional healthcare, like gym membership reimbursements, childcare services, and mental health support. LSAs are highly scalable and adaptable, making them well-suited to support diverse employee needs beyond conventional medical or benefits gaps. This flexible approach to benefits comes with important tax considerations and LSA tax rules.

Here’s what we’ll cover:

- Is an LSA taxable?

- LSAs are post-tax benefits for employers and employees alike

- How to manage LSA tax compliance

- Ensuring tax compliance with an LSA

- FAQs about LSA taxation

While most LSA reimbursements are taxable, some categories may qualify for different tax treatment under certain conditions. These can include qualified tuition reimbursements, work-from-home expenses, or specific wellbeing costs, depending on local laws and plan structure.

Is an LSA taxable?

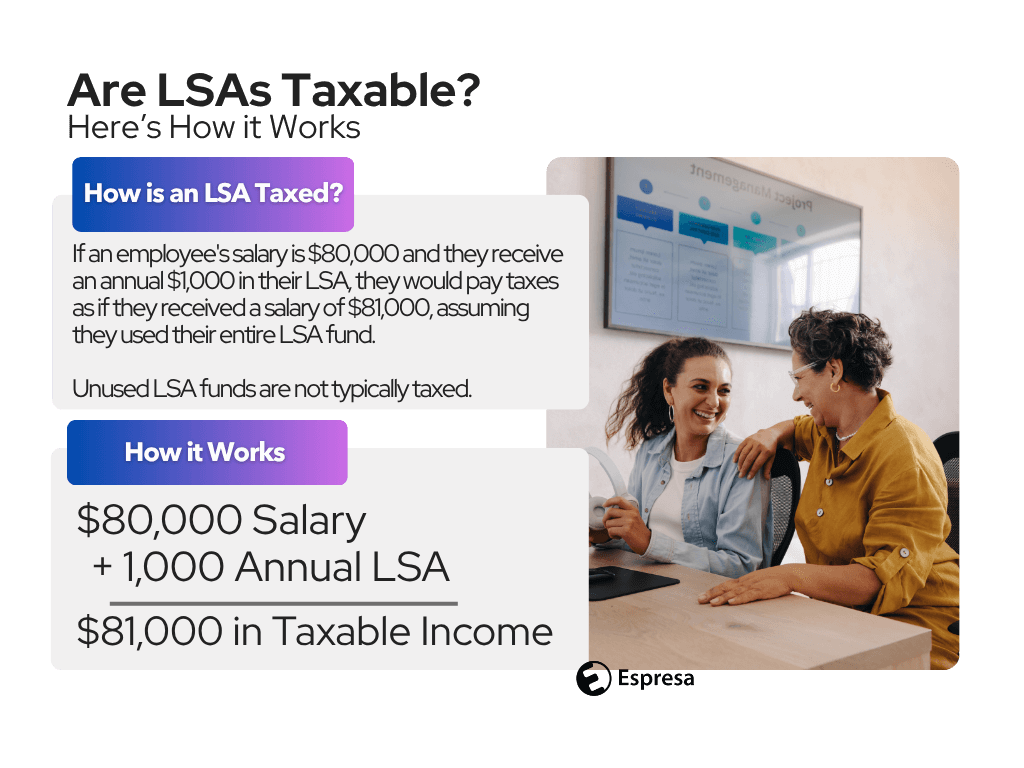

Generally, Lifestyle Spending Accounts are considered taxable benefits. However, tax treatment can vary depending on local laws and the specific structure of the LSA. They are distinct from other benefits programs like Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA). Typically, the company treats reimbursed LSA funds—unless otherwise specified—as taxable income to the employee.

When an LSA is offered, reimbursements are typically included in gross income and taxed accordingly. LSA taxation can change depending on where you are, the plan design, and how you use it.

LSAs are post-tax benefits for employers and employees alike

Post-tax benefits are not inherently less valuable than pre-tax benefits. While each has its pros and cons, an LSA’s post-tax nature enables greater program flexibility. Pre-tax accounts like HSAs and FSAs are restricted to health plans, offer limited global support, and provide fewer accessibility options.

When designed effectively, post-tax benefits like LSAs promote flexibility without the burden of intense compliance restrictions.

Tax treatment of LSAs

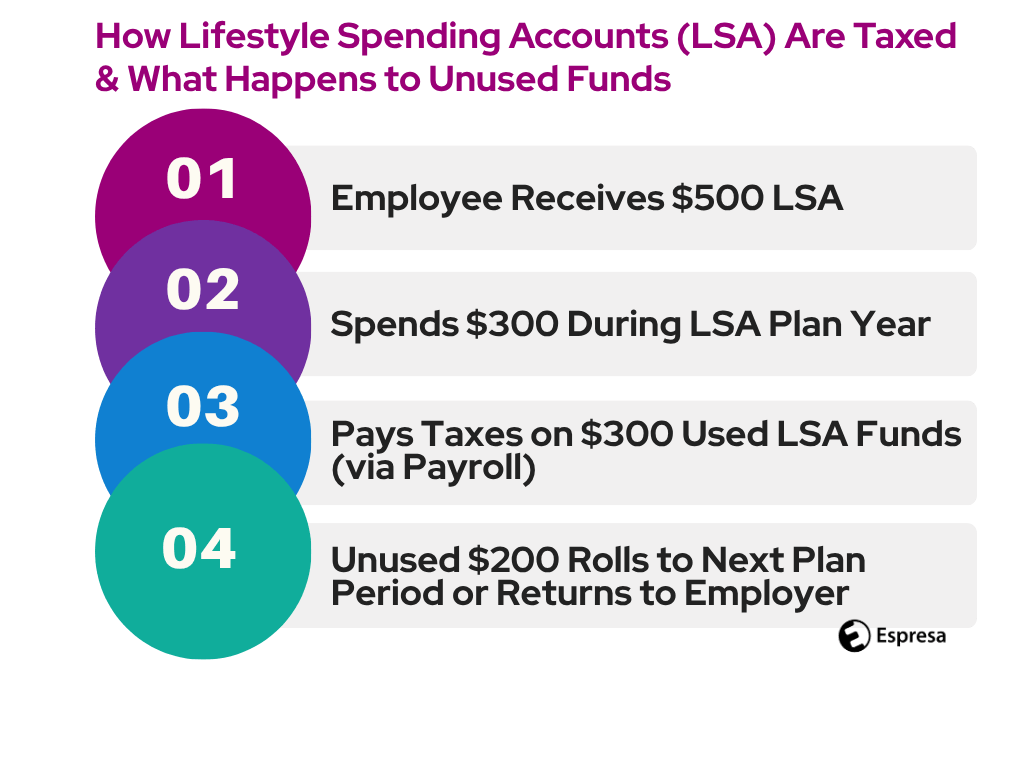

As a post-tax benefit, LSA funds are taxed when they’re reimbursed, not when they’re allocated. Only the portion of LSA funds spent is typically considered taxable income. Unused funds may roll over within the plan period based on the organization’s policy, but at the end of the plan year, they are returned to the employer. In most cases, unused funds are not taxed.

Explore more LSA Terms in our Glossary

LSA tax benefits for employers

The tax implications of Lifestyle Spending Accounts extend beyond employee reimbursements. Employer contributions to LSAs are generally tax-deductible as business expenses. This allows organizations to tailor benefit offerings that reflect company values, support workforce wellbeing, and reduce overall taxable income.

At the same time, it is essential to communicate the taxable nature of LSAs to employees clearly. Transparent communication helps prevent tax-season surprises and reinforces the value of LSAs as part of a well-rounded compensation strategy.

How LSAs are taxed for employees

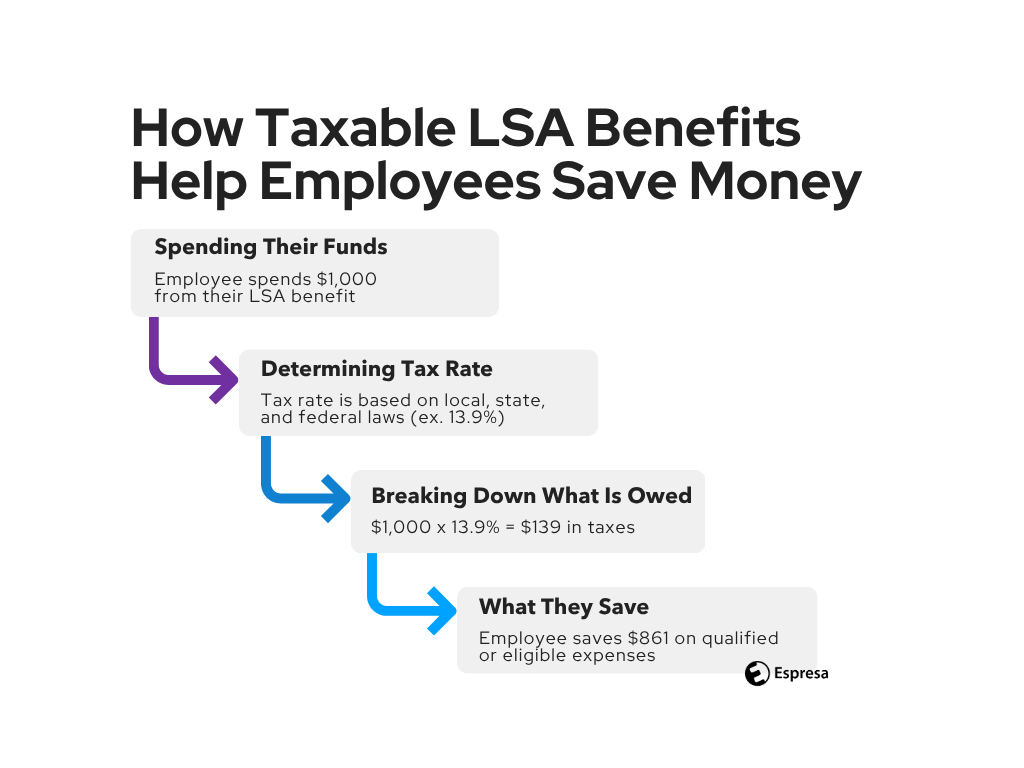

Taxation of LSAs generally mirrors regular income taxation, except in cases where funds remain unused. LSAs are more flexible than FSAs, HSAs, and other tax-advantaged options. They allow for more eligible expenses and have fewer rules.

Common reimbursements include wellness-related items, home office improvements, mental health support tools, and similar non-medical expenses. Plan curation is key, as eligible wellness expenditures vary. These benefits provide support for personal wellbeing without the rigidity of medical-use restrictions. However, all reimbursements remain subject to applicable taxes.

Take a closer look at how organizations build inclusive and equitable LSA offerings tailored to meet diverse employee needs.

How to manage LSA tax compliance

LSA tax compliance in the U.S. is often simpler than it seems. By avoiding medical expenses in their LSA (per IRS 213 (d)), employers can easily avoid group health plan regulations like ERISA or COBRA.

Exceptions to LSA taxability

While most LSA reimbursements are taxable, some categories may qualify for different tax treatment under certain conditions. These can include qualified tuition reimbursements, work-from-home expenses, or specific wellbeing costs, depending on local laws and plan structure.

Organizations should consult qualified tax professionals when determining whether certain reimbursements qualify for different tax treatment. Guidance is highly context-specific and should be reviewed regularly.

Communicate LSA tax rules to employees

Clear communication is essential to the success of any LSA program. While LSAs offer meaningful and flexible support for employee wellbeing, it’s important to ensure employees also understand how reimbursements are taxed.

Reimbursements through LSAs are generally considered taxable income and are subject to FICA, Medicare, and applicable federal, state, and local taxes. Framing these details as part of a transparent and well-designed benefits package helps set accurate expectations and reinforces trust in the program.

Ensuring tax compliance with an LSA

LSAs are a highly valued and flexible employee perk, offering broad support for wellbeing initiatives. With a thoughtful understanding of general LSA tax principles, employers and employees can maximize the benefits of LSAs while maintaining compliance with regulations.

Optimizing Lifestyle Spending Account benefits through clear communication, policy alignment, a thoughtful tax strategy, and awareness of taxable treatment can enhance employee satisfaction and foster a wellness-focused workplace while staying tax-compliant.

Ready to elevate your benefits strategy? Partner with Espresa to design and implement LSAs that are flexible, tax-compliant, and tailored to your team’s needs. Discover how we can help you foster a culture of wellbeing and engagement, and contact Espresa today.

FAQs about LSA taxation:

Are LSAs considered taxable income?

Yes. In most cases, Lifestyle Spending Account reimbursements are treated as taxable income and reported accordingly. Only funds that are actually used are typically taxed.

What LSA expenses are tax-exempt?

Most LSA expenses are taxable, but certain categories–such as tuition assistance or specific work-from-home costs–may qualify for different tax treatment under defined conditions. A tax advisor should review the program design for any exceptions.

How do LSAs differ from FSAs and HSAs for tax purposes?

Unlike FSAs and HSAs, which are pre-tax and limited to medical-related expenses, LSAs are post-tax and offer broader flexibility. However, they do not carry the same tax-advantaged status.

What’s the difference between LSA in the U.S. and FSA globally?

In many countries outside the U.S., LSA is often referred to as a Flexible Spending Account (FSA). However, this is not the same as a U.S. FSA, which is a tax-advantaged, pre-tax account limited to qualified medical and dependent care expenses.

By contrast, LSA (or FSA globally) are employer-funded, post-tax benefits that support a wider range of lifestyle, wellbeing, and professional development expenses (e.g., fitness, mental health, family support, learning, or wellness perks).

For global employers, it’s best practice to clarify this distinction in employee communications, since the term “FSA” can mean very different things depending on the country.

Can LSA funds roll over?

That depends on the employer’s policy. Unused LSA funds may be allowed to roll over from one period to the next (such as monthly or quarterly) within a plan year. However, they typically do not roll over from one plan year to the next, as doing so may raise issues related to deferred compensation. Unlike certain FSA balances, LSA funds are not automatically carried forward.

What’s the best practice for applying imputed income on an upfront annual LSA stipend?

If you’re providing an annual LSA stipend upfront (regardless of the amount), it’s best practice to apply the imputed income incrementally — either monthly or quarterly. This approach helps align with payroll cycles and reduces the immediate tax burden on employees.

Note: Employers can choose the frequency that works best for their organization, but spreading the imputed income over time is generally recommended for smoother reporting and employee experience.

How to Future-Proof Your Workplace with Flexible Benefits for Remote and In-Office Teams

Ready to See Espresa in Action?

Discover how HR leaders are using Espresa to boost employee engagement, retention, and workplace culture. Schedule a demo today to explore how we can support your team’s unique needs globally and equitably.

Alex Shubat

Alex Shubat is the co-founder and CEO of Espresa, based in Palo Alto, California.

More by Alex Shubat