Delivering affordable healthcare benefits has never been more critical, or more complex. Prescription drug prices are rising faster than wages, creating a widening gap between cost and access. Employees are making difficult trade-offs between health and household needs.

For employers, the implications go far beyond health plan budgets. Soaring drug prices affect access, equity, and employee trust, creating ripple effects across wellbeing, engagement, and retention. As HR leaders rethink the role of benefits in supporting the modern workforce, one theme stands out: flexibility is no longer a perk—it’s a strategy.

The question isn’t how to contain costs. It’s how to design benefits that protect affordability, strengthen trust, and reinforce wellbeing in an era where healthcare feels increasingly out of reach.

Here’s what we’ll cover:

- Why healthcare affordability is the next frontier of HR strategy

- How cost pressures are reshaping benefit philosophy

- Financial wellness as a foundation for workforce resilience

- Benefit design levers that HR can pull

- Specialty allowances: support in an evolving benefits landscape

- What 2025 benefit trends reveal about the future of flexibility

- Building a culture of care: leadership lessons for HR

- From cost management to human-centered strategy

Why healthcare affordability is the next frontier of HR strategy

Prescription drug costs have become a leading indicator of workforce strain. In 2025, specialty medication prices rose nearly 8%, outpacing wage growth by more than double. For employees, this translates into difficult choices: skipping doses, delaying care, or absorbing new debt. For employers, it signals a deeper cultural risk—the erosion of psychological safety and financial trust among employees.

With healthcare costs projected to rise another 9% in 2026, driven largely by pharmacy spend and the growing use of GLP-1 medications, HR leaders face mounting pressure to balance affordability with access. HR now stands at a crossroads. Traditional benefit levers—plan design, co-pays, and deductibles—can no longer absorb cost volatility. The next generation of benefits must be adaptive, equitable, and empathetic.

When choice replaces control, benefits become a two-way contract: employees feel cared for, and employers gain predictability, equity, and deeper trust.

How cost pressures are reshaping benefit philosophy

Flexibility is the new architecture of affordability. In Willis Tower Watson’s 2025 Benefits Trends Survey, 90% of U.S. employers identified rising benefit costs as a primary influence on their strategy, and many are shifting spend rather than expanding offerings.

Organizations are experimenting with flexible benefit models. Allocating dollars into choice-based accounts or stipends so employees can prioritize what matters most, whether it’s prescriptions, family care, wellness, or preventive services. This shift signals a move away from rigid cost sharing toward empowering employees with choice and autonomy. When choice replaces control, benefits become a two-way contract: employees feel cared for, and employers gain predictability, equity, and deeper trust.

Financial wellness as a foundation for workforce resilience

Financial wellness is quickly emerging as a cornerstone of workforce sustainability. WTW research shows that nearly two-thirds of employees feel stressed about their finances, and those under financial strain are twice as likely to report disengagement or poor health.

When medical costs rise faster than pay, this stress compounds. Forward-thinking organizations are addressing it head-on by integrating financial wellbeing into their benefit ecosystems. From budgeting tools and savings incentives to credit-building supports.

While Lifestyle Spending Accounts (LSA) can’t be used for healthcare-covered medical expenses, they play a vital role in reducing everyday financial pressure, which in turn supports better overall wellbeing. Financial security and health are interconnected: employees who feel in control of their finances are more likely to participate in preventive care, stay healthy, and remain loyal to their employer. In an era defined by economic uncertainty, financial confidence is becoming a leading indicator of organizational health.

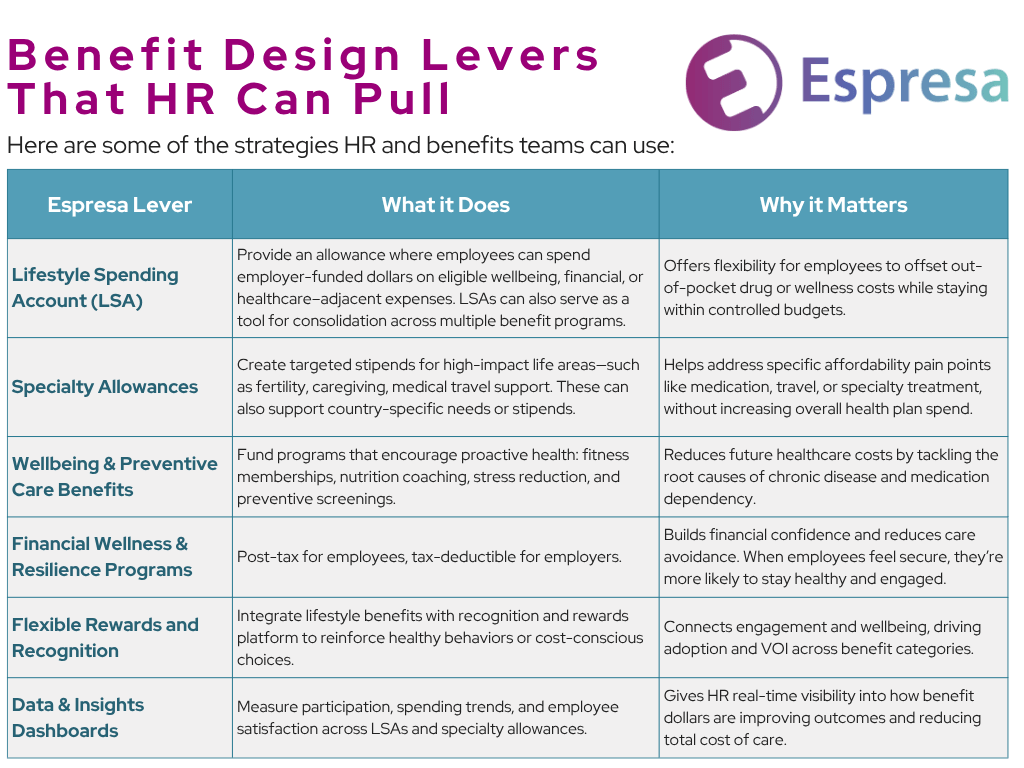

Benefit design levers that HR can pull

As the cost curve steepens, HR teams are redefining what proactive benefit management looks like. The most effective strategies blend financial, physical, and emotional wellbeing into one framework, giving employees flexibility while keeping employer costs predictable and controllable.

The chart below highlights several proven levers HR leaders are using to close affordability gaps, drawn from Espresa’s latest data on flexible benefit adoption.

Specialty allowances represent a maturing benefits philosophy: one rooted in relevance, inclusivity, and intentional design. By aligning benefits with lived experience, employers signal understanding that health and wellbeing are personal, not transactional.

Specialty allowances: support in an evolving benefits landscape

As healthcare costs diversify, benefit design must evolve beyond broad-based coverage to targeted, equitable support. Specialty allowances—targeted stipends for specific life events or circumstances—are becoming a defining feature of modern benefit design. Employers are using them to address needs such as fertility, medical travel, caregiving, or medically-necessary travel, areas often underserved by traditional insurance plans.

Rather than adding layers of programs, these allowances redirect resources to where they have the most tangible impact. They enable employees to navigate high-cost or sensitive health events with dignity, while allowing organizations to maintain predictability and cost discipline while employees maintain privacy and security.

Specialty allowances represent a maturing benefits philosophy: one rooted in relevance, inclusivity, and intentional design. By aligning benefits with lived experience, employers signal understanding that health and wellbeing are personal, not transactional.

What 2025 benefit trends reveal about the future of flexibility

Across industries, flexibility has moved from experiment to expectation. Recent employer data shows a decisive shift towards benefits that are modular, choice-based, and responsive to employee needs. Nearly 9 in 10 employers now consider health and wellbeing benefits central to their people strategy. Yet participation in traditional wellness programs continues to decline, signalling a move away from rigid structures toward personalization and self-direction.

Flexible stipends and lifestyle benefits have emerged as preferred mechanisms for delivering personalization. Adoption rates are accelerating, with organizations reframing benefits as ecosystems of choice rather than static offerings. These programs enable employees to allocate funds toward supporting their unique wellbeing—from family care to preventive health or prescription costs—while allowing employers to manage cost volatility with clarity and equity.

Key insights from 2025 benefit data illustrate this transformation:

- 68% of employers now offer an LSA or specialty allowance, up from 42% in 2023

- Engagement rates exceed 80% across flexible benefit programs, even amidst tighter budgets

- Personalization has overtaken cost as the top driver of employee satisfaction with benefits

- Financial wellbeing programs are expanding within flexible frameworks, supporting budgeting, savings, and debt management alongside physical and emotional health

- Core health benefits remain critical:

- 88% of employers rate them as “extremely” or “very” important, according to SHRM

- Yet only 39% of organizations now offer structured wellness programs (down from 53% in 2021), reflecting a transition from prescriptive to self-directed care

Together, these trends mark a shift from benefits that are offered to benefits that are employee-led. Flexibility is more than adding options; it’s about redistributing agency.

Building a culture of care: leadership lessons for HR

The rising cost of healthcare has forced HR to evolve beyond benefits administration and into benefits equity. In an environment where affordability, equity, and trust intersect, the design of personal benefits becomes a direct reflection of how an organization values its people.

3 lessons stand out as HR navigates this new challenge:

1. Equity begins with design

True benefit equity is about intentional design that meets people where they are. Programs should reflect diverse life stages, health needs, and family structures, ensuring that flexibility isn’t a privilege only some employees receive.

2. Choices drive engagement

When employees have a voice in how benefits are shaped, such as with surveys, participation becomes ownership. Shared decision-making turns benefits from a corporate offering into a shared experience.

3. Transparency sustains trust

Clear communication about how benefits are prioritized and funded is essential. Particularly when trade-offs are required. Employees don’t expect unlimited resources, but they do expect honesty. HR leaders who explain why certain programs are chosen, or why adjustments are made, cultivate understanding rather than doubt.

Together, these practices reimagine HR leadership as a partnership between the organization and its people. One that moves beyond managing plans to co-creating a culture of wellbeing and fairness.

From cost management to human-centered strategy

Healthcare inflation will continue to test the limits of traditional benefit models. This pressure is also accelerating innovation, pushing HR leaders to move beyond cost control toward human-centered strategy.

The future of benefits lies in integration and intent: connecting health, financial, and emotional wellbeing into one adaptable ecosystem that reflects organizational values. When benefits are aligned through equity, transparency, and empathy, they stop functioning as separate programs and start communicating a unified message: People come first.

For HR, this moment redefines purpose. The future of benefits will be shaped by deliberate organizational spending. Those that lead with flexibility and authenticity will not only weather volatility, they’ll help their people thrive through it.