In a world where employee expectations are evolving faster than policy, HR leaders and people teams are reimagining what meaningful benefits look like. Flexibility, personalization, and wellbeing have become strategic drivers of engagement and retention—fueling a new generation of flexible employee benefits that adapt to the diverse needs of today’s workforce.

Traditional benefits are no longer enough to differentiate or inspire long-term loyalty. Employees expect personalization and flexibility in how their total rewards reflect their lives, priorities, and evolving needs.

A Lifestyle Spending Account (LSA) offers a modern, structured approach to employee benefits. It provides post-tax benefits that give individuals the freedom to spend company-provided funds on wellbeing, family, personal development, and more. All within a clear and compliant framework.

This article outlines how LSAs work, why leading employers are implementing them, and the measurable impact they deliver for workforce engagement and organizational culture.

What we’ll cover:

- What is a Lifestyle Spending Account?

- Growing interest in flexible benefits

- How does a Lifestyle Spending Account work?

- How is an LSA set up?

- How is an LSA funded?

- Is an LSA taxable? Understanding lifestyle account tax implications

- How can employees earn LSA funds?

- What can an LSA be used for? Eligible expenses LSA guide

- Combining lifestyle benefits with specialty allowances

- LSA Benchmarks & Trends: what leading employers are offering

- Benefits of a Lifestyle Spending Account

- How does an LSA compare to HSA and FSA?

- How to design a Lifestyle Spending Account program

- Get started with a Lifestyle Spending Account

- Common Questions About Lifestyle Spending Accounts

What is a Lifestyle Spending Account?

A Lifestyle Spending Account is an employer-funded, post-tax benefit that operates much like modern employee stipends, allowing employees to get reimbursed for a broad range of lifestyle wellness benefits and wellbeing expenses.

These could include:

- Fitness memberships

- Mental health tools

- Childcare benefits

- Professional development benefits

- Tuition reimbursement

- Family-forming stipends

- Pet care or pet insurance

- Financial coaching or wellness tools

- Nutrition consulting

- End-of-Life doula or eldercare services

Each organization defines which expenses are eligible, how much is funded, and how frequently reimbursements occur. This makes LSAs one of the most adaptable and inclusive modern benefits available.

For HR and People teams, LSAs offer a scalable, equitable model that reflects your workforce’s diversity while supporting a more values-driven culture. At its core, it’s a flexible employer-paid lifestyle account that empowers employee choice within a structured, budget-conscious program.

Growing interest in flexible benefits

According to the SHRM 2024 Employee Benefits Survey, employers continue to prioritize benefits that attract and retain top talent in a competitive job market. While health-related benefits, retirement savings, and leave benefits remain foundational, there is a growing emphasis on flexible working benefits with 70% offering them and 67% offering family-friendly benefits. Ωt the same time, flexible benefits programs, like LSAs or workplace stipends, are rising in popularity as people-first employers explore modern, post-tax benefits that give employees more choice and control.

Forward-thinking organizations recognize that evolving benefits packages are essential for strengthening company culture and improving retention rates. Traditional offerings such as health insurance and retirement plans are expected, but modern benefits—like flexible spending for lifestyle options—help organizations stand out.

These flexible programs are rising in popularity as people-first employers explore modern, post-tax benefits that give employees more freedom. The rise of workplace stipends and LSAs reflect a broader shift toward flexibility, personalization, and empowerment in total rewards design.

How does a Lifestyle Spending Account work?

Lifestyle Spending Accounts operate as a reimbursable lifestyle expenses program.

Here’s the typical employee flow:

- Spend on an eligible category

- Submit receipt for approval

- Receive approval and reimbursement (typically issued within the next payroll cycle)

- See the amount reflected on the paystub as taxable employee benefits

This creates a transparent, easy-to-manage employee reimbursement program that fits seamlessly into any total rewards strategy.

Note: While payroll reimbursement is the most common approach, employers can also offer alternative methods such as direct deposit, LSA debit cards, or even shopping directly through an integrated marketplace for eligible products and services.

How is an LSA set up?

Lifestyle Spending Accounts offer high flexibility for employers when designing and implementing benefits. Unlike tax-advantaged accounts such as FSAs or HSAs, LSAs are post-tax and carry fewer regulatory restrictions, allowing organizations to launch programs at any point in the year without the need to align their traditional benefits plan cycle.

Plan design flexibility

Employers have full discretion over the structure of the LSA program. Key elements typically include:

- Contribution amount per employee

- Funding frequency, such as monthly, quarterly, or annually

- Eligibility rules, based on employment type (e.g., full-time, part-time, contract) or geographic location

- Eligible expense categories, aligned with organizational values or wellbeing strategies

LSAs can be structured as one-time contributions or recurring allocations, with the option to pro-rate based on employee start dates or status. This level of customization supports inclusive design across roles, regions, and employment types.

Employee access and adaptability

LSAs are not tied to open enrollment periods, which means programs may be designed to allow employees to enroll or make changes at any time during the year. This structure supports greater flexibility for employees to adapt their benefits, responding to personal life changes without being restricted to an annual benefits window.

Administration and scalability

Administration can be handled internally or through an HRIS, benefits platform, or third-party vendor. External partners can manage verification, approvals, and reimbursement workflows—reducing operational lift for internal teams while maintaining employee privacy.

Flexible and globally adaptable, LSAs can be tailored to support both centralized and decentralized workforce strategies, helping organizations deliver personalized benefits at scale.

How is an LSA funded?

LSAs are employer-funded accounts, so employers decide the scope of health and wellness expenses. LSA funds are post-tax benefits provided to employees as part of their total rewards package, meaning employees pay income taxes on the money they spend from their LSAs.

Since Lifestyle Spending Accounts use after-tax funds, employers have much more freedom in determining reimbursement categories and flexible spending for lifestyle options. Employers can direct spending in a way that aligns with the company culture and values.

With an average utilization rate of 80% by employees, LSAs ensure that you only fund what your employees actually spend while saving the rest, making it a cost-effective investment in your employees’ wellbeing.

Is an LSA taxable? Understanding lifestyle account tax implications

Yes, LSA reimbursements are considered taxable income for employees. When an employer provides LSA benefits, the funds are typically added to the employee’s gross income, and taxes are applied accordingly:

- Regular payroll (as gross income)

- Year-end tax documents

While they’re not tax-advantaged like HSAs or FSAs, post-tax benefits offer a level of design flexibility unmatched by traditional plans.

Employers should clearly communicate this structure so employees understand how the benefit appears on their paycheck.

When designed with intent, earned LSA models create a flexible, culture-aligned layer within the broader total rewards ecosystem–supporting both individual empowerment and organizational purpose.

How can employees earn LSA funds?

Incentivized LSA models offer creative ways to tie values and behaviors together. Employers can incentivize behaviors by offering additional earned funds for actions such as:

- Completing wellness challenges

- Participating in volunteer efforts

- Taking financial wellness classes

- Attending training sessions

- Upskilling milestones

These initiatives encourage alignment between total rewards and company values while expanding access to employee wellbeing benefits. Because earned allowances are customizable, employers can tailor incentives to fit their culture and goals.

With a values-centered expense type, you can shape a people-positive policy that reflects your organization’s purpose—creating a flexible, culture-driven layer to your LSA.

Employers can bring these incentives to life through meaningful programs that celebrate wellbeing, community, and personal growth:

Volunteer engagement

Employees may be rewarded for dedicating time to charitable causes, whether through company-sponsored events or independent volunteer efforts. A volunteer reimbursement program not only encourages philanthropic engagement but also supports broader corporate social responsibility and inclusion strategies.

Participation in wellness programs

Wellness-based incentives can include activities like completing an annual physical exam, nutrition course, mental health workshop, or on-demand fitness class. These efforts contribute to overall employee health while aligning the intent of a lifestyle wellness benefit.

Financial wellness milestones

Reward employees who prioritize their financial wellness. Your people can earn funds by attending a financial planning seminar, completing a debt reduction program, or setting up a retirement savings plan or college savings account; all part of broader financial wellness benefits.

When designed with intent, earned LSA models create a flexible, culture-aligned layer within the broader total rewards ecosystem—supporting both individual empowerment and organizational purpose.

What can an LSA be used for? Eligible expenses LSA guide

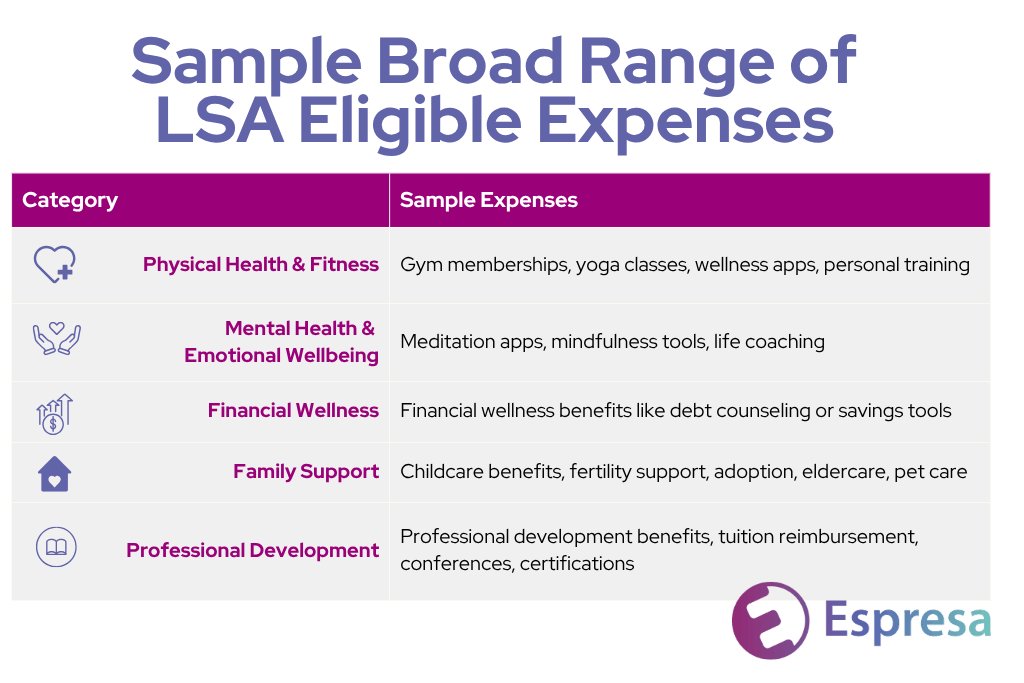

Lifestyle Accounts can cover a broad range of expenses that promote employees’ total wellbeing. While specific categories are defined by the employer, eligible expenses typically fall into one of five expense categories:

- Physical health and fitness

- Mental health and emotional wellbeing

- Financial wellbeing

- Professional development

- Family support, including family-forming benefits and caregiving resources

By offering broad, inclusive categories, LSAs enable employees to personalize their benefits based on what matters most in their current life stage.

Lifestyle Spending Accounts are more than flexible—they’re transformative. By design, they support an employee-led benefits framework that puts choice and autonomy in the hands of each person, aligning personal needs with organizational culture.

Tailored to individual needs

Wellness is not one-size-fits-all. Expanding eligible expenses across multiple life dimensions allows employees to make meaningful choices and improve their satisfaction with the organization’s total rewards offerings.

Below are some LSA examples that show how employees can use their benefits to support wellbeing, development, family needs, and more:

- Financial wellness benefits: budgeting tools, debt counseling, savings programs

- Professional development benefits: certifications, online courses, industry conferences

- Mental and emotional health support: therapy sessions, mindfulness apps, burnout workshops

- Physical wellbeing: gym memberships, yoga classes, tai chi, personal training

- Family-related support: fertility treatments, adoption assistance, childcare, postpartum care, eldercare, and even pet care

Empowering choice and autonomy

Employers determine which expenses qualify under the LSA plan and allocate funds per employee, either on a one-time or recurring basis. Once approved, employees have the flexibility to spend their allowance on eligible items that align with their personal priorities—supporting a more self-directed and reliable approach to wellbeing.

This freedom of choice makes LSAs especially effective in meeting the needs of a diverse, global workforce—providing structure and flexibility where it matters.

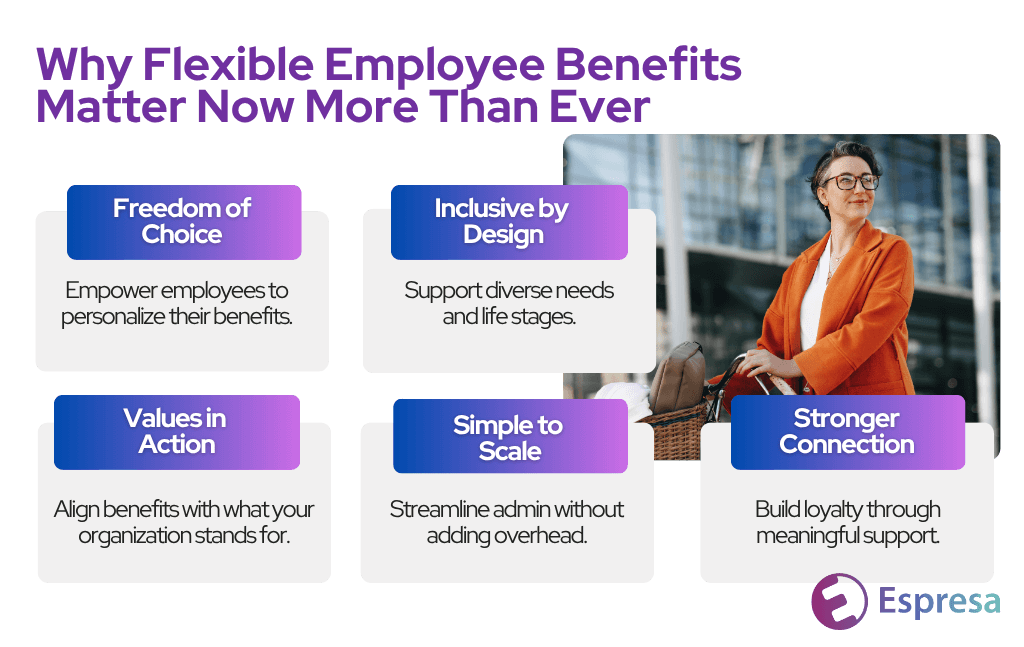

Benefits of a Lifestyle Spending Account

Lifestyle Spending Accounts are more than flexible—they’re transformative. By design, they support an employee-led benefits framework that puts choice and autonomy in the hands of each person, aligning personal needs with organizational culture.

Key advantages:

- Flexibility: Employees choose what’s important to them

- Equity: A single benefit can serve diverse life stages and identities

- Culture-building: Reinforces values through behavioral alignment

- Efficiency: Scalable and easy to administer with the right partner

- Retention and attraction: Modern benefits help win and keep top talent

When evaluating modern benefit designs, HR teams often compare wellness stipend vs LSA programs to determine which provides greater flexibility and measurable impact. LSAs consistently stand out for their adaptability and ability to strengthen employee engagement and company culture.

Beyond these core advantages, LSAs deliver even greater impact when designed with inclusion, proactivity, and flexibility at their foundation.

Inclusive

LSAs promote equity by allowing employees to choose benefits that reflect their unique life experiences and priorities. Whether the focus is on childcare benefits, financial wellbeing, or commuter support, employees gain autonomy over their own wellness journeys.

When aligned with company values, LSAs reinforce an inclusive culture—supporting employees across various life stages, roles, and regions. This adaptability helps organizations deliver inclusive benefits strategies that resonate deeply and build a stronger sense of belonging.

Proactive

As a proactive employee benefit, an LSA helps fund lifestyle needs not typically covered by traditional health insurance—such as mental health support, community engagement, and fitness pursuits.

Programs can inspire healthy lifestyle choices while reinforcing a people-first culture. For example, an organization may reimburse registration for a long-distance bike race. In preparing, the employee may adopt healthier habits—training consistently, improving nutrition, and enhancing emotional resilience. The benefit extends well beyond the event itself, fostering wellbeing through intentional investment.

This type of proactive support signals to employees that their holistic health matters—building trust and long-term engagement.

Flexible

LSAs offer exceptional adaptability. Employers can choose to make the program broad—covering a wide array of lifestyle and wellbeing categories—or focus on specific areas such as professional development, family support, or financial wellness benefits.

This design flexibility allows for clear alignment with company culture and business goals. Organizations can structure LSAs to reflect core values, incentivize desired behaviors, and support evolving workforce needs, all while maintaining cost predictability and administrative ease.

Combining lifestyle benefits with specialty allowances

For organizations looking to go beyond standard wellness reimbursements, LSAs can integrate seamlessly with specialty allowances, niche programs, and inflation benefits. These additional programs champion highly personalized, employee-centric benefit experiences—supporting needs such as family-forming benefits, professional growth, community involvement, and personal passions.

Pairing LSAs with targeted, non-taxable or regionally compliant allowances enables employers to deliver a more comprehensive and flexible total rewards strategy.

Examples include:

- Wellbeing allowance for preventive health programs and mental health tools

- Family support allowance for fertility and childcare-related costs

- Health support allowance for out-of-pocket pharmaceutical costs or prescriptions not covered by insurance

- Remote work stipend for home office setup or internet reimbursement

Built for global flexibility and compliance

LSAs are highly adaptable to regional requirements. When paired with specialty allowances, benefit plans can be customized for compliance with local tax laws and employment regulations across global workforces. Employers can define which benefits are taxed or tax-exempt by location and category, maintaining consistency while adhering to in-country requirements.

This layered approach enables HR leaders to meet the unique needs of diverse teams around the world—offering meaningful choice, honoring cultural context, and ensuring global compliance without compromising administrative simplicity.

Together, LSAs and specialty allowances offer a flexible, scalable framework for delivering inclusive benefits that reflect employees’ realities and preferences—wherever they are.

Tailoring LSAs for regions and teams with flexible employee benefits

LSAs allow employers to offer inclusive, flexible employee benefits that scale across global teams without creating inequity. By setting parameters for employer-paid lifestyle accounts and regionally appropriate spending categories, HR teams can deliver equitable experiences across markets while respecting local culture and cost of living.

LSA Benchmarks & Trends: what leading employers are offering

Across industries, employers use LSAs to fund a variety of lifestyle benefits: from wellness and learning to family and financial wellbeing. Organizations implementing LSAs report higher participation in wellbeing programs and improved perception of employee wellbeing benefits overall.

- Average annual LSA budgets range from $500 to $1,500 per employee

- Top categories include mental health, fitness, and home office equipment

Recent benchmark and trends reports highlight steady year-over-year growth in LSA adoption, particularly among employers expanding flexible benefits programs and wellness offerings. To explore specific program outcomes, see our latest case studies featuring leading employers and their unique benefits plan.

How does an LSA compare to HSA and FSA?

A Lifestyle Spending Account offers greater customization, freedom, and inclusivity than its traditional counterparts such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA).

While HSAs and FSAs focus primarily on medical expenses and pre-tax savings, LSAs unlock a broader spectrum of lifestyle and wellbeing benefits. Unlike these pre-tax accounts, LSAs are taxable employee benefits that can include a broad range of health and wellness expenses tailored to the needs of the individual. Flexible by design, the LSA goes beyond traditional benefits to promote total wellbeing.

How to design a Lifestyle Spending Account program

Creating an effective LSA starts with strategy. Employers begin by defining their goals, setting budgets, and aligning eligible expenses with company values.

A thoughtful LSA design guide helps HR teams balance flexibility and compliance while maintaining fairness and impact across diverse employee groups.

When designing your LSA, consider:

- What outcomes do you want to support (wellbeing, learning, company values or corporate social responsibility, family, development)?

- How will you measure those outcomes? (utilization rates, eNPS shifts, member satisfaction scores)

- What eligible expenses will you include?

- How will you manage taxable employee benefits and compliance by region?

- How can LSAs complement existing employee stipends, workplace stipends, or specialty allowances (such as inflation benefits or medical travel benefits)?

- How will your LSA integrate into a unified platform that connects to your broader employee engagement programs—including wellbeing initiatives, communities, challenges, and recognition?

A unified approach that brings multiple employee engagement benefits—such as wellbeing, recognition, communities, and challenges—into one offering allows organizations to create cohesive employee experiences that strengthen culture, enhance participation, and build long-term organizational resilience.

Get started with a Lifestyle Spending Account

Lifestyle Spending Accounts are flexible, off-cycle benefits. With fewer regulatory hurdles than traditional tax-advantaged accounts, LSAs are simple to implement and scale across your organization.

Ready to create a healthier, more engaged workforce? Espresa’s LSA platform makes it easy to design, launch, and manage a program that reflects your culture and supports your people.

Learn more about LSAs and workplace stipends:

Let’s build a benefits program that empowers choice and drives impact. One that meets employees where they are and reflects what matters most.

Common Questions About Lifestyle Spending Accounts

How are LSAs distributed?

LSAs are typically funded as post-tax benefits, meaning reimbursements are treated as taxable employee benefits and reflected on the employee’s paystub. Funds can be distributed through payroll, direct deposit, debit cards, or integrated marketplaces.

How do LSA claims work?

Employees submit receipts or documentation for eligible expenses. Once approved, they receive reimbursement according to the company’s selected method (usually payroll or direct deposit).

What privacy do LSA users have?

HR teams can view reimbursement categories but not sensitive medical or financial details. Claims processing remains confidential.

How do LSAs differ from stipends?

While both are post-tax benefits, LSAs are structured and compliant with defined categories and approval workflows, whereas stipends are simpler lump-sum payments with fewer guardrails.