Your employees are craving healthy connections in this remote and hybrid work world. Another team call isn’t going to cut it. Employees want relevant and flexible benefits so they feel valued and supported as individuals.

Addressing your employees’ unique needs and ensuring they feel valued can help to attract new talent and build loyalty. Offering a Lifestyle Spending Account (LSA) demonstrates you care for employees’ well-being, which increases employee engagement and job satisfaction.

So what is a Lifestyle Spending Account, and how does it work? Keep reading to learn more about this popular employee benefit and why it’s become essential in the modern workplace.

What we’ll cover:

-

- What is a Lifestyle Spending Account?

- How does a Lifestyle Spending Account work?

- How is an LSA set up?

- How is an LSA funded?

- Is an LSA taxable?

- How can employees earn LSA funds?

- What can an LSA be used for?

- Combining lifestyle benefits with specialty allowances

- Benefits of a Lifestyle Spending Account

- How does an LSA compare to HSA and FSA?

- Get started with a Lifestyle Spending Account

What is a Lifestyle Spending Account?

A Lifestyle Spending Account is an employer-sponsored benefit that supports employees’ overall health and wellness. LSAs cover a variety of wellness and lifestyle expenses, such as gym memberships, child care, mental health services, and more. They are a great way for employers to show their commitment to creating a happy and healthy workplace for their employees.

Lifestyle Spending Accounts may also be referred to as lifestyle benefits, lifestyle reimbursement, perks, allowances, employee stipends, and wellness or well-being wallets. The common denominator with an LSA by any name is that there is a predetermined amount for employees based on the plan design and budget.

Growing interest in flexible benefits

According to the SHRM 2024 Employee Benefits Survey, employers continue to prioritize benefits that attract and retain top talent in a competitive job market. While health-related benefits, retirement savings, and leave benefits remain foundational, there is a growing emphasis on flexible working benefits with 70% offering them and 67% offering family-friendly benefits.

Forward-thinking employers recognize that evolving benefits packages are essential for strengthening company culture and improving retention rates. Traditional offerings such as health insurance and retirement plans are expected, but modern benefits—like flexible spending options—help organizations stand out. LSAs are an example of a personal or lifestyle benefit that goes beyond the norm, providing employees with personalized ways to support their well-being, family needs, and professional growth.

How does a Lifestyle Spending Account work?

Unlike typical benefits programs, Lifestyle Spending Accounts offer ultimate flexibility. Beyond fitness reimbursements, LSAs allow freedom of choice to give back where it matters.

Wherever your employees are, you can create a customized LSA to meet their needs and values while aligning with your company’s mission and vision. With an LSA, you can design your own benefit model and determine the eligible population, dollar amount, funding frequency, and spending timeframe. Employees can use their LSA funds to invest in their own health and well-being.

LSA funds are considered taxable income, which means the benefits may be added to the employee’s gross income and taxed accordingly.

How is an LSA set up?

Lifestyle Spending Accounts are an off-cycle benefit. No need to align to a benefits plan year; you can launch an LSA any time of the year. Since LSAs have fewer regulatory requirements than Flexible Spending Accounts or a Health Savings Accounts, you can implement it whenever you’re ready.

Employers may choose to make a one-time contribution at the beginning of the year or contribute on a per-pay-period basis. Unlike traditional benefits, employees might have the flexibility to enroll in or make changes to their LSA outside the usual open enrollment window. This can provide greater flexibility and convenience, allowing employees to adjust their lifestyle benefits in response to changes in their personal circumstances or needs throughout the year, rather than being restricted to the annual open enrollment period.

LSAs can have a pro-rated plan design. Flexible amounts, tailored to employee status (contract, part-time, full-time, and more) in any location worldwide.

Employers can choose to administer LSAs directly or outsource their management to an employee benefits platform, which can provide relief for HR professionals and privacy for employees regarding their choices.

How is an LSA funded?

LSAs are employer-funded accounts, so employers decide the scope of health and wellness expenses. LSA funds are provided to employees as a taxable benefit as part of their benefits package, meaning employees pay income taxes on the money they spend from their LSAs. The plans are 100% customizable with no parameters on expenditures and no budgetary minimums or maximums outside of the employer’s plan design.

Because LSAs use after-tax funds, employers have much more freedom in determining reimbursement categories. Employers can choose eligible expenses for LSAs and direct spending in a way that aligns with the company culture and values.

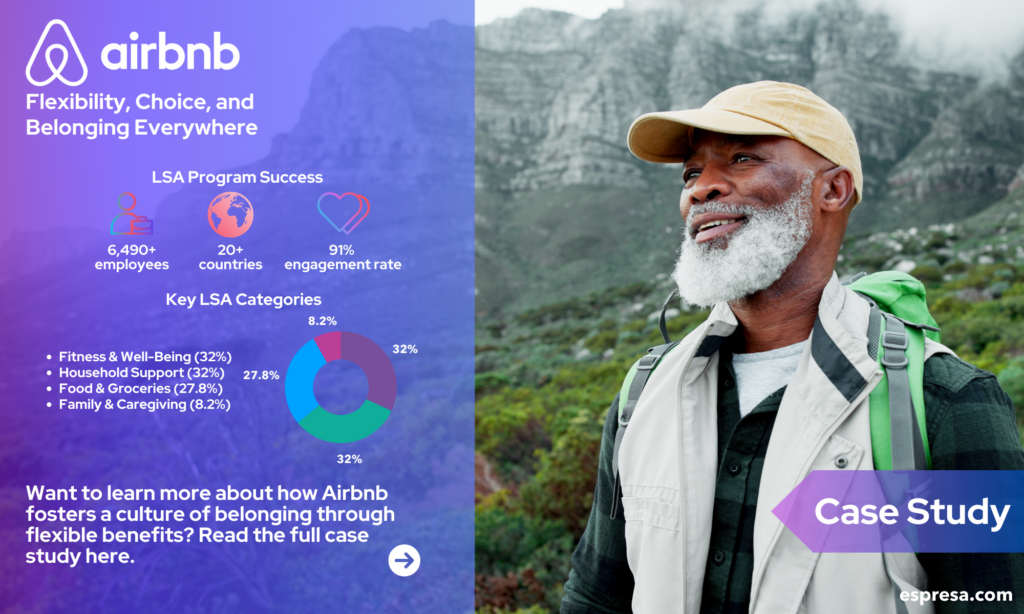

With an average utilization rate of 80% by employees, LSAs ensure that you only fund what your employees actually spend, making it a cost-effective investment in your employees’ well-being.

Is an LSA taxable?

Yes, Lifestyle Spending Account (LSA) funds are considered taxable income for employees. When an employer provides LSA benefits, the funds are typically added to the employee’s gross income, and taxes are applied accordingly.

Unlike pre-tax benefits like a Health Savings Account (HSA) or Flexible Spending Account (FSA), LSAs are funded with after-tax dollars. This gives employers greater flexibility in designing their LSA offerings—choosing reimbursement categories that align with company values and employee preferences—without the regulatory restrictions tied to tax-advantaged accounts.

While this means employees are responsible for paying income taxes on the funds they use, the payoff is the highly customizable nature of LSAs. Employees gain access to an expansive array of wellness and lifestyle options, from gym memberships to childcare, mental health services, and beyond. To learn more about how LSA funds are taxed and what it means for your paycheck, read our full article on LSA taxation.

Employers should clearly communicate the taxable nature of LSAs to avoid surprises during tax season and ensure employees fully understand the benefit’s value as part of their compensation package.

How can employees earn LSA funds?

Earned allowance offerings are unique to every organization. Incentivized challenges provide creative ways for employers to encourage their people to earn funds for their Lifestyle Spending Accounts while supporting the company values.

Set your people-positive policy to align with your LSA goals with a values-centered expense type. The ultimate, bolt-on customization for your people-first culture. Here are some ideas:

Volunteer work

Allow your people to put their volunteer time where their values are by supporting employees who volunteer their time and energy for charitable causes. Whether through company-sponsored volunteer events or individual volunteer efforts, a Volunteer Reimbursement Program can drive philanthropic engagement.

Supporting volunteer efforts through LSAs also enhance your company’s corporate social responsibility initiatives.

Participation in wellness programs

Promote employee wellness by rewarding certain activities and achievements related to health and well-being with LSA funds. Wellness expenses may include an annual physical exam, a biometric screening, flu shots, a nutrition course, attending a stress management workshop, learning how to meditate, attending fitness classes, or participating in on-demand fitness offerings.

Financial Wellness

Reward employees who prioritize their financial wellness. Your people can earn funds by attending a financial planning seminar, completing a debt reduction program, or setting up a retirement savings plan or college savings account.

What can an LSA be used for?

A Lifestyle Spending Account can cover any expenses related to promoting employees’ total well-being. An eligible expense typically falls into one of five expense categories: physical health and fitness, mental health and emotional well-being, financial management, professional development, or family support—including family-forming benefits like fertility treatments and adoption assistance, as well as parental benefits like childcare or postpartum care.

Wellness is not one-size-fits-all. Offering a wide range of eligible expenses can significantly enhance employee satisfaction by catering to diverse needs.

The employer determines qualified expenses for the LSA and provides an allowance for each employee. Employees can choose how to spend their LSA funds and prioritize their well-being according to their individual needs and interests.

Read more about eligible expenses for Lifestyle Spending Accounts

Benefits of a Lifestyle Spending Account

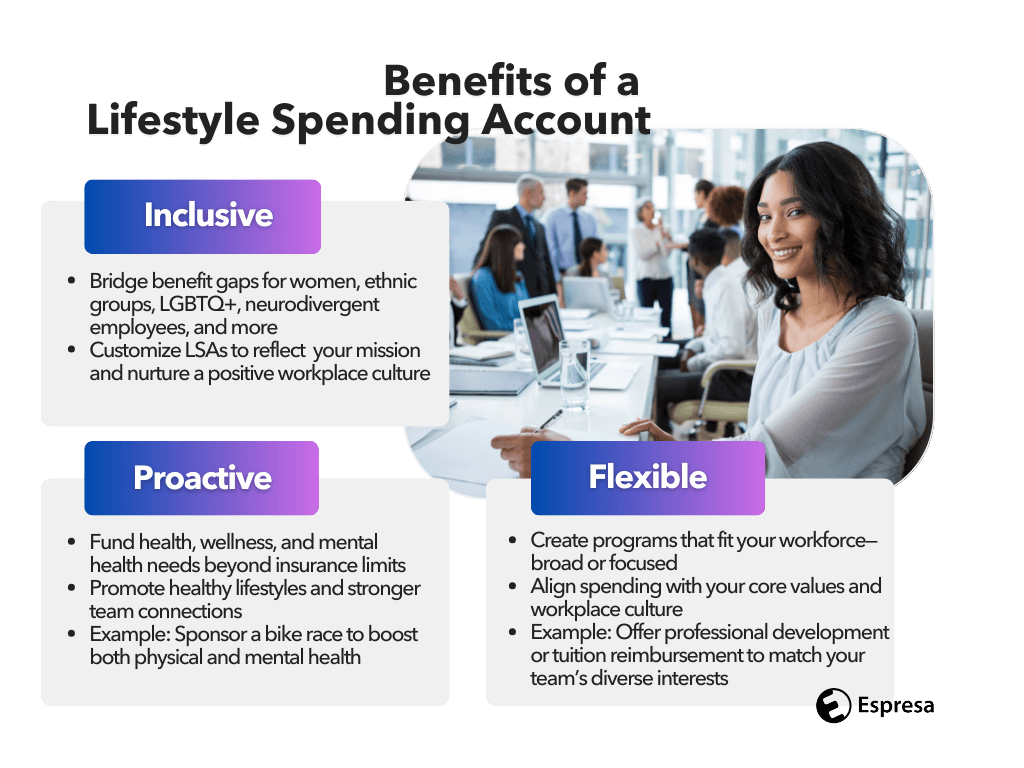

Inclusive

Employers pursuing diversity, equity, and inclusion (DEI) initiatives may view Lifestyle Spending Accounts as a straightforward way to address benefit gaps for various groups. These include women, specific racial and ethnic groups, LGBTQ+ individuals, neurodivergent employees, and more.

By customizing your LSA to meet the specific needs of your workforce and aligning it with your company’s mission and vision, you can create a positive and inclusive workplace culture.

Proactive

An LSA is a proactive employee benefit program that funds health and wellness needs not covered by traditional health insurance plans, including mental health. Employers can encourage healthy lifestyle choices and strengthen relationships with their employees at the same time.

For example, if a company is willing to cover the cost for an employee to participate in a bike race, that employee will dedicate extensive time to training, eating well, and getting mentally prepared for the competition. The employee benefits not only from the experience of participating in the race itself but also from a healthier mind and body as a result of their efforts. This is all made possible by the company’s investment in their employees’ well-being.

Flexible

Your benefits program can be super broad or hyper-focused, depending on how you want to address your employees’ individual needs. You can direct spending that aligns with your company’s culture and core values.

Combining lifestyle benefits with specialty allowances

For organizations looking to go beyond standard wellness reimbursements, LSAs can integrate seamlessly with specialty allowances and niche benefits. These tailored benefits allow employers to design employee-centric benefit experiences, supporting everything from family-forming to professional development and personal passions. Specialty allowances expand the LSA toolkit, making it possible to meet employees where they are with benefits that matter most to them.

How does an LSA compare to HSA and FSA?

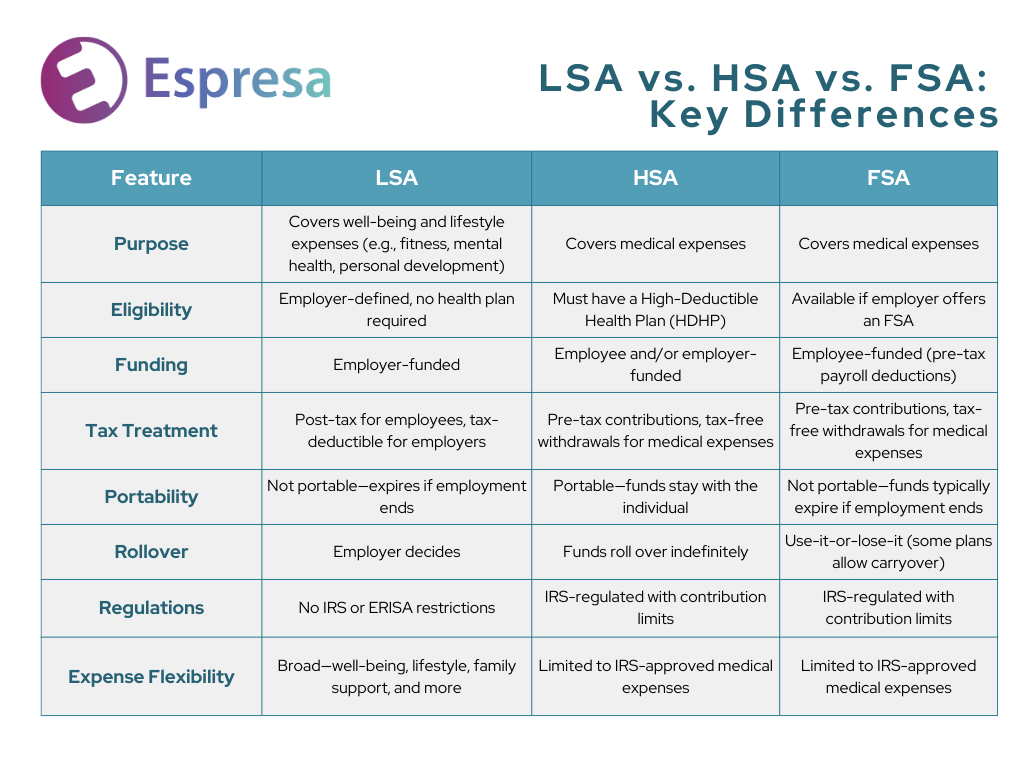

A Lifestyle Spending Account offers more customization and flexibility than its better-known counterparts, the Health Savings Account (HSA) and Flexible Spending Account (FSA).

- A Health Savings Account is a tax-advantaged account for qualified medical expenses that is only available to those with High-Deductible Health Plans. An HSA is owned by the individual and is portable, meaning it stays with the person if they change jobs or leave the workforce.

- A Flexible Spending Account functions much in the same way as an HSA, but it is typically offered by employers and can be used with any type of health plan, not just HDHPs. It is employee-funded through pre-tax payroll deductions and must be used for qualified medical expenses. Unlike Health Savings Accounts, Flexible Spending Accounts have a ‘use-it-or-lose-it’ policy where funds must be utilized within the plan year.

Unlike other spending accounts, an LSA covers a broad range of health wellness expenses that can be tailored to the needs of the individual. Flexible by design, the LSA goes beyond traditional benefits to promote total well-being.

Learn more about Lifestyle Spending Accounts vs. Flexible Spending Accounts

Get started with a Lifestyle Spending Account

Getting started with a Lifestyle Spending Account for your company is easy since it can be launched as an off-cycle benefit at any time during the year.

Take the first step towards creating a healthier and more engaged workforce. Learn more about Espresa’s Lifestyle Spending Account platform and contact us for a free demo today!

Alex Shubat

Alex Shubat is the co-founder and CEO of Espresa, based in Palo Alto, California.

More by Alex Shubat